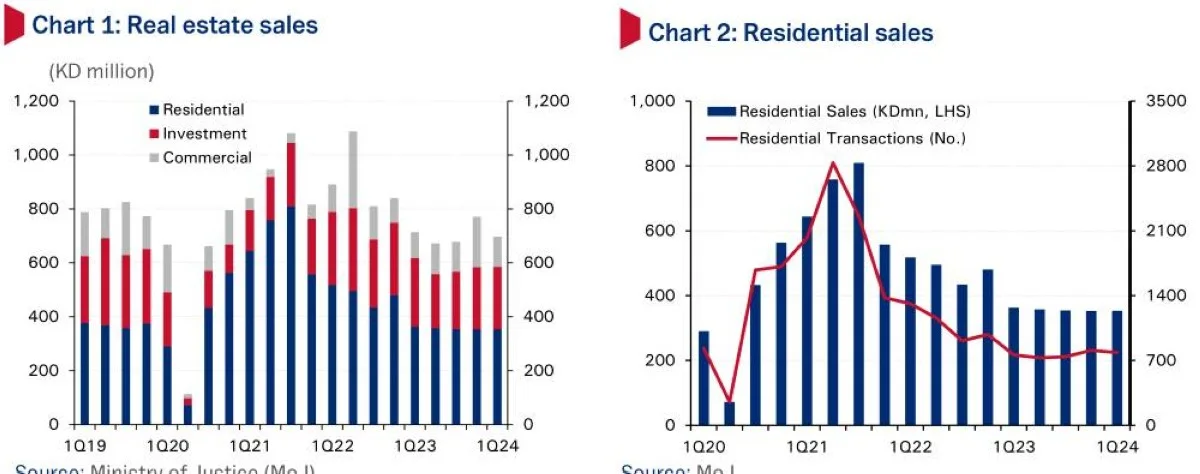

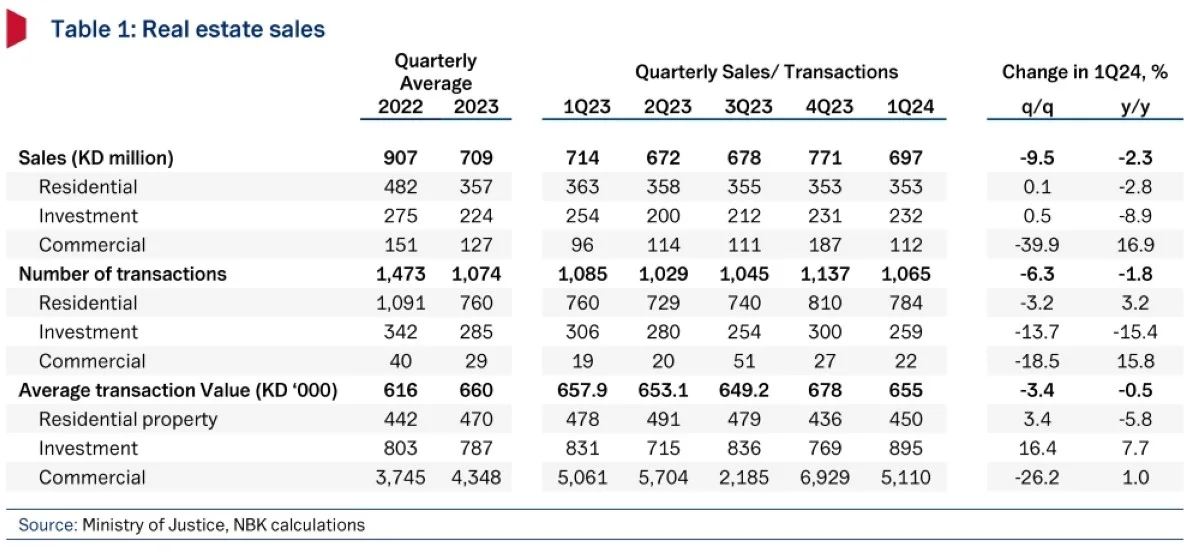

KUWAIT: Having picked up at the end of last year, real estate sales dipped again in Q1 2024 as commercial sector sales fell while other sectors were steady. Our overall real estate price index showed a modest year-on-year rise, but prices in the residential sector eased slightly.

Some of the softness in market activity in Q1 could be due to seasonal factors, but while sales levels could improve going forward, we expect any pick-up in 2024 to be constrained by the sluggish economic climate, elevated interest rates and affordability issues in the residential segment. Upside risks include a faster pace of interest rate cuts, stronger credit growth and more rapid implementation of housing-related reforms.

Total sales in Q1 2024 declined by -9.5 percent q/q to KD 697 million, having jumped 13.6 percent in Q4 2023. However, in yearly terms, the decline in real estate sales continued to ease, suggesting that the trend of steadying conditions across the sector following declines since mid-2022 remains intact.

Residential sales in Q1 24 were stable q/q at KD 353 million, though the number of transactions, at 784, fell during the quarter and remained at historically low levels. In addition to the factors mentioned above, such low demand levels could be due to reduced speculation in the segment given low sentiment, uncertainty over market reforms and improved yields on deposits resulting in delayed buying decisions. Still, on a yearly basis residential sales saw their smallest decline since Q4 2021, supporting the view that sales may have reached the bottom of the cycle.

In the investment (ie apartment and apartment building) segment, sales were helped by a solid performance in March though remained at moderate levels for the quarter and still fell 9 percent compared to the same quarter in 2023. Transaction volumes dipped by 13.7 percent q/q with sales in Al-Ahmadi governorate (Al-Mahboulah) rising to acquire nearly 39 percent of total quarterly sales, partly offsetting transaction declines in Hawally and Al-Farwaniya governorates. We note that housing rent inflation as recorded in the consumer price index fell back to only 1.4 percent y/y in March from a peak of 3.2 percent in mid-2023, suggesting a lack of strength in the apartment segment, while growth in credit to real estate firms, although improving a bit recently, remained lackluster at 2.5 percent y/y in February.

More positively, the recent resumption of family visa issuance for expatriates (who account for most apartment demand) combined with relatively attractive valuations within this segment compared to the residential sector, should provide some support for demand going forward. Commercial segment sales, which jumped in Q4 2023 on large deals, adjusted back down in Q1 and dipped below their 2023 average quarterly levels.

Most of the sales remained in Kuwait City and Hawally governorates. Transaction volumes also declined to their lowest level since Q2 2023, with average transaction sizes declining by 26 percent q/q, pointing to a shift toward less luxurious or smaller size properties.

Investment segment

Our overall real estate price index, which is calculated based on Ministry of Justice transaction data, registered a marginal increase of 0.4 percent q/q in Q1 2024, reversing the -0.9 percent q/q decline in the previous quarter. The improvement came from a smaller decline in residential prices. On the other hand, investment segment prices saw their second solid quarterly rise in a row (+2.7 percent q/q). On a yearly basis, real estate price rises were little changed, rising by 1.4 percent in Q1 2024, with the investment segment (5.0 percent) outperforming the residential segment (-1.4 percent), helping to close the valuation gap between the two.

According to the Public Authority for Housing Welfare (PAHW), residential plot distributions eased during Q1 2024 to 2,145 plots from 3,030 plots in the previous quarter. This was likely due to seasonality factors. Distributions were focused in South Sa’ad Al-Abdullah city (N4), but overall numbers remained broadly in line with historical levels. The city of South Sa’ad Al-Abdullah remains the main current source for residential plot distributions, with 14,042 distributed so far out of 24,508 residential plots available under the project.

PAHW is also working on distributing 4,400 residential units in Taima and Al-Sulaibiya areas while tendering the infrastructure works for seven districts in South Sabah Al-Ahmad city with total residential units of 13,812. The number of outstanding applications for the government housing program at the end of March rose by 0.8 percent q/q compared with a 4.6 percent increase in the previous quarter, to reach 96,090 applicants.